Asset Location Can Be as Important as Asset Allocation

With advisory annuities, taxes are generally deferred until clients begin making withdrawals. This helps optimize earnings by allowing their money to potentially grow and accumulate faster than it could in many taxable accounts. And, when clients begin withdrawing retirement income, they may be in a lower income-tax bracket, which would reduce the tax burden during their retirement years. In addition, annual contribution limits in tax-deferred retirement accounts such as 401(k)s and IRAs can be an obstacle for those who need to catch up on saving for retirement. Advisory annuities have no annual contribution limits, giving clients the opportunity to save more tax-deferred money for the future.

The Unforseen Impact of Stealth Taxes

It’s crucial in today’s environment to look beyond tax rates to understand how lesser-known taxes, often referred to as "stealth taxes" can potentially have an unforeseen impact on clients' assets during retirement. Taxation of Social Security retirement benefits and the Net Investment Income Tax (NIIT) are examples of stealth taxes. Additionally, distribution activity that increases adjusted gross income (AGI) may move clients into a different income tax bracket and cause an increase in Medicare premiums. These are just a few considerations that if not properly planned for, can increase income-tax liability, and reduce lifetime after-tax retirement income for your clients. Encourage your clients to consult with an independent tax advisor and perhaps consider adding an advisory annuity to their overall financial plans. Advisory annuities offer features that provide clients with growth potential and tax deferral to help accumulate retirement savings and address some of the stealth tax hits clients may take in retirement.

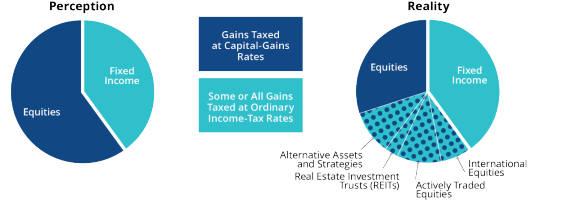

Ordinary Income vs. Capital Gains—The Big Surprise

Many clients know they can expect to pay capital-gains taxes on the growth of the equities portion of their portfolios. However, they can be surprised to find out that some of their equity investments generate annual income taxed at ordinary income-tax rates—regardless of whether the client wants or needs that income. Paying more in taxes during years of accumulation can significantly impact the growth of clients’ portfolios, which over time, can potentially reduce the amount of money they keep.

Grow and Manage Clients’ Wealth Tax-Efficiently

Locating a portion of your clients’ portfolios into our advisory annuities allows them to tap into the power of tax deferral, which can be an important wealth accumulation tool when saving for retirement.

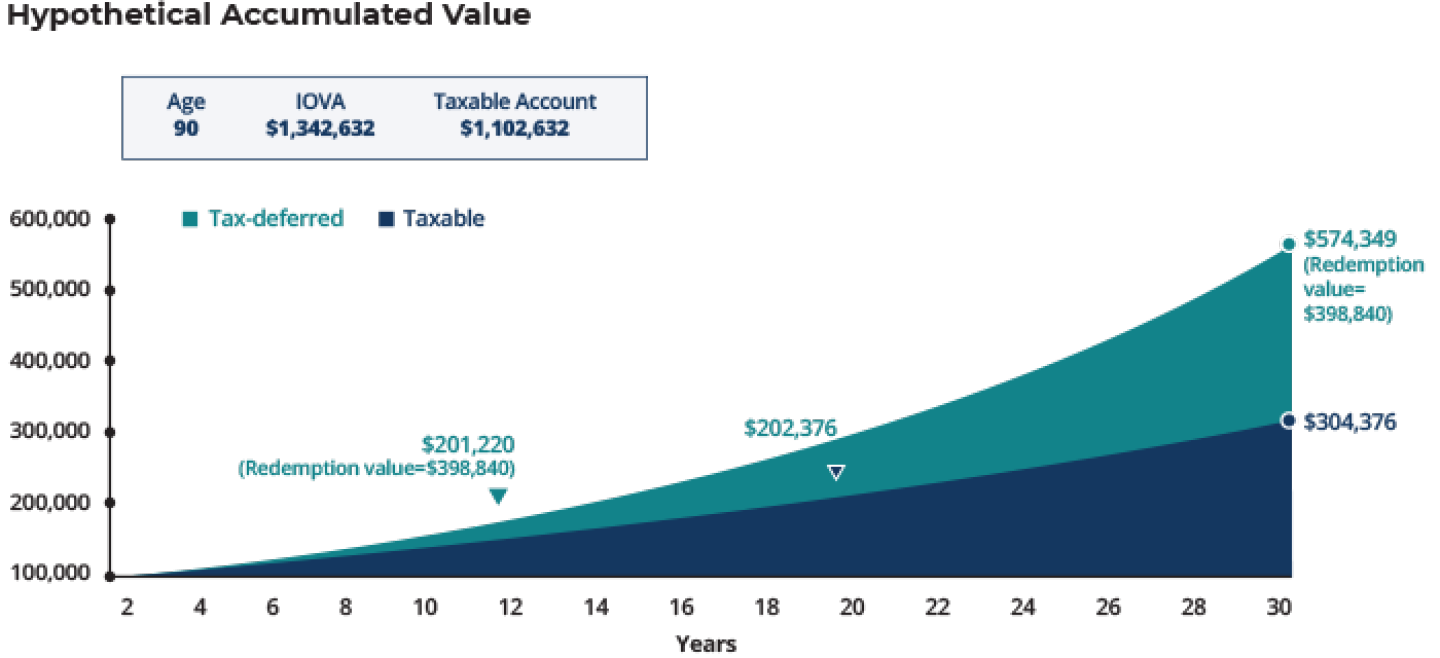

Demonstrate the Long-Term Value of Tax Deferral

Show clients what tax deferral can do for them in all phases of their retirement journeys.

The chart is hypothetical and for illustrative purposes only. Complete the form to run scenarios using data specific to a client. You can then print a report of the results.

Annuities are long-term contracts designed for retirement. Annuity withdrawals and other distributions of taxable amounts, including death benefit payouts, will be subject to ordinary income tax. For nonqualified contracts, an additional 3.8% federal tax may apply on net investment income. If withdrawals and other distributions are taken prior to age 59½, an additional 10% federal income tax may apply. A withdrawal charge also may apply and a market value adjustment (MVA) also may apply. Withdrawals will reduce the contract value and the value of the death benefit, and also may reduce the value of any optional benefits.

Under current law, a nonqualified annuity that is owned by an individual is generally entitled to tax deferral. IRAs and qualified plans—such as 401(k)s and 403(b)s—are already tax deferred. Therefore, a deferred annuity should be used only to fund an IRA or qualified plan to benefit from the annuity’s features other than tax deferral. These features include lifetime income, death benefit options, and the ability to transfer among investment options without sales or withdrawal charges.

Insurance products and their guarantees, including optional benefits, annuity payout rates, and any crediting rates, are backed by the financial strength and claims-paying ability of the issuing insurance company, but they do not protect the value of the variable investment options. Look to the strength of the insurance company with regard to such guarantees because these guarantees are not backed by the independent broker/dealers, insurance agencies, or their affiliates from which products are purchased. Neither these entities nor their representatives make any representation or assurance regarding the claims-paying ability of the issuing company.

Pacific Life, its distributors, and respective representatives do not provide tax, accounting, or legal advice. Any taxpayer should seek advice based on the taxpayer's particular circumstances from an independent tax advisor or attorney.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products.

Pacific Life refers to Pacific Life Insurance Company and its subsidiary Pacific Life & Annuity Company. Insurance products can be issued in all states, except New York, by Pacific Life Insurance Company and in all states by Pacific Life & Annuity Company. Product/material availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Variable insurance products are distributed by Pacific Select Distributors, LLC (member FINRA & SIPC), a subsidiary of Pacific Life Insurance Company and an affiliate of Pacific Life & Annuity Company.

The home office for Pacific Life & Annuity Company is located in Phoenix, Arizona. The home office for Pacific Life Insurance Company is located in Omaha, Nebraska.

For financial professional use only. Not for use with the public.

25-119A

MUQ2675-RIA-00

8/25 E828